CMS-1561A 2002-2026 free printable template

Show details

DEPARTMENT OF HEALTH AND HUMAN SERVICES CENTERS FOR MEDICARE MEDICAID SERVICES FORM APPROVED OMB No. 0938-0832 HEALTH INSURANCE BENEFITS AGREEMENT Agreement with Rural Health Clinic Pursuant to Section 1861 aa 2 K ii of the Social Security Act For the purpose of establishing eligibility for payment under Title XVIII of the Social Security Act Insert name of clinic hereafter referred to as the Rural Health Clinic hereby agrees A to maintain compliance with the conditions for certification set...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign agreement to provide insurance pdf form

Edit your insurance agreement sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance agreement template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cms 1561 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit agreement to provide insurance form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letter of agreement insurance form

How to fill out CMS-1561A

01

Gather all necessary documentation and patient information.

02

Begin filling out Section A by providing institutional information, including the name and address.

03

Complete Section B, ensuring you provide the date of service and the applicable procedure codes.

04

In Section C, indicate the patient’s Medicare enrollment information.

05

Fill out Section D with details about the healthcare provider, including their National Provider Identifier (NPI).

06

Review and confirm all information is accurate and complete before submitting.

07

Sign and date the form where indicated.

Who needs CMS-1561A?

01

Healthcare providers submitting claims for inpatient hospital services under Medicare.

02

Providers seeking reimbursement or authorization for healthcare services.

Fill

health insurance contract

: Try Risk Free

People Also Ask about insurance contract template

What is in an insurance agreement?

This is a summary of the major promises of the insurance company and states what is covered. In the Insuring Agreement, the insurer agrees to do certain things such as paying losses for covered perils, providing certain services, or agreeing to defend the insured in a liability lawsuit.

How do I create an agreement form?

Here are the steps to write a letter of agreement: Title the document. Add the title at the top of the document. List your personal information. Include the date. Add the recipient's personal information. Address the recipient. Write an introduction paragraph. Write your body. Conclude the letter.

What four requirements must be met to form a binding insurance contract?

There are four necessary elements to comprise a legally binding contract: (1) Offer and acceptance, (2) consideration, (3) legal purpose, and (4) competent parties. The effective date of a policy is the date the insurer accepts an offer by the applicant "as written."

What is a letter of agreement?

A: A Letter of Agreement is a legally binding document exactly like a contract. LoAs tend to be shorter, with less provisions and clauses. With less detail than a huge 50+ page contract, parties could be more exposed to risk when using a Letter of Agreement.

What is the purpose of the letter of agreement?

A letter agreement is a written legal document that is made between two parties who want a simple way to make their discussions of a transaction official. An agreement letter is binding by the law and can technically be written by just about anybody.

What is a letter of agreement with insurance?

The purpose of an insurance agreement is to create a legally binding contract between the insurance company and the insured. Within this agreement, the insured agrees to pay small periodic payments in exchange for a payout from the insurance company if the covered event specified in the agreement occurs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete letter of agreement health insurance online?

Completing and signing cms 1561 form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit what is required for individual health insurance contracts straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing medicare, you can start right away.

How do I fill out medical insurance contract on an Android device?

Complete claim form for health insurance and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

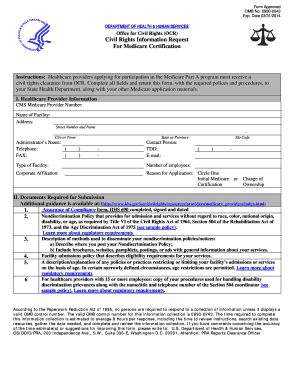

What is CMS-1561A?

CMS-1561A is a form used by healthcare providers to report certain information to the Centers for Medicare & Medicaid Services (CMS) as part of the Medicare enrollment process.

Who is required to file CMS-1561A?

Healthcare providers who are applying to enroll in the Medicare program or are making changes to their enrollment must file CMS-1561A.

How to fill out CMS-1561A?

To fill out CMS-1561A, providers should follow the instructions provided with the form, ensuring all required fields are completed accurately, and submit it to the appropriate Medicare Administrative Contractor (MAC).

What is the purpose of CMS-1561A?

The purpose of CMS-1561A is to collect essential information regarding healthcare providers, which is necessary for their enrollment in the Medicare program and to ensure compliance with Medicare regulations.

What information must be reported on CMS-1561A?

CMS-1561A requires providers to report information such as their legal business name, tax identification number, practice location, services offered, and ownership details.

Fill out your CMS-1561A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Before A Life Insurance Policy Is Issued Which Of These Components Of The Contract Is Required is not the form you're looking for?Search for another form here.

Keywords relevant to medicare 1500 form

Related to cms signature attestation form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.